UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| Preliminary Proxy Statement | ||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| Definitive Proxy Statement | ||

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

GE INVESTMENTS FUNDS, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

N/A | |||

| (2) | Aggregate number of securities to which transaction applies:

N/A | |||

| (3) | Per share price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

N/A | |||

| (4) | Proposed maximum aggregate value of transaction:

N/A | |||

| (5) | Total fee paid:

$0 | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

N/A | |||

| (2) | Form, Schedule or Registration Statement No.:

N/A | |||

| (3) | Filing Party:

N/A | |||

| (4) | Date Filed:

N/A | |||

GE INVESTMENTS FUNDS, INC.

U.S. EQUITY FUND

PREMIER GROWTH EQUITY FUND

SMALL-CAP EQUITY FUND

S&P 500 INDEX FUND

CORE VALUE EQUITY FUND

INCOME FUND

TOTAL RETURN FUND

REAL ESTATE SECURITIES FUND

1600 Summer Street

Stamford, Connecticut 06905

SPECIAL MEETING OF SHAREHOLDERS

YOUR VOTE IS IMPORTANT

[●],September 23, 2016

Dear Contract Owner:

We are asking for your support for a series oftwo important proposals (the “Proposals”) affecting your investment in one or more of the investment portfolios of the GE Investments Funds, Inc. (the “Company”) listed above (each, a “Fund,” and collectively, the “Funds”). A special meeting of shareholders (the “Meeting”) of the Funds will be held to consider the Proposalsproposals at 1600 Summer Street, Stamford, Connecticut 06905, on [●],November 2, 2016, at [●]10:00 a.m. (Eastern Time). As a record owner of a variable annuity contract or variable life insurance contract (each, a “variable contract”) investing in the Funds, you have the right to instruct Genworth Life and Annuity Insurance Company, Genworth Life Insurance Company of New York, Pacific Life Insurance Company, or Transamerica Life Insurance Company, as applicable, as to the manner in which the shares of the Funds attributable to your variable contract should be voted.

At the Meeting, shareholders will be asked to consider and vote on proposals to amend the followingArticles of Incorporation of the Company, as amended and/or restated to date (the “Articles of Incorporation”), to change the name of the Company and to permit the Board of Directors of the Company (the “Board”) to approve future name changes without shareholder approval (the “Proposals”). The Proposals which relate to the rebranding of the Company in connection with the asset purchase agreement entered into on March 29, 2016 by General Electric Company (“GE”) with State Street Corporation (“SSC”) for the sale of the asset management and advisory services business conducted by GE Asset Management Incorporated (“GEAM”), a wholly owned subsidiary of GE and the Funds’ investmentthen-investment adviser, and certain of its subsidiaries (the “Transaction”). TheIn connection with the Transaction, is expected to close inat a special meeting of shareholders of the third quarter ofFunds held on June 22, 2016, pending receipt of certain regulatory approvalsthe shareholders approved, among other proposals, a new investment advisory and subject to satisfaction of other customary closing conditions. Pursuant to the Transaction,administration agreement for each Fund with SSGA Funds Management, Inc. (“SSGA FM”), an affiliate of SSC, will acquirepursuant to which SSGA FM replaced GEAM as investment adviser and administrator to the rights, title and interest in certain assets, and assume certain liabilities,Funds upon consummation of GEAM. Under applicable law, the Transaction will result inon July 1, 2016.

Historically, and consistent with a common industry practice, the automatic terminationname of each Fund’s currentthe Company has reflected the name of the investment advisory and sub-advisory agreements.adviser to the Funds. Given that SSGA FM has replaced GEAM as investment adviser to the Funds, SSGA FM determined that it would be appropriate for the name of the Company to reflect its affiliation with SSGA FM, the Funds’ new investment adviser, by changing the Company’s name to State Street Variable Insurance Series Funds, Inc. In order to change the Company’s name, it is necessary to amend the Articles of Incorporation to reflect the new name. As a result, all Fund shareholders are being asked to approve new agreements that will providean amendment to the Articles of Incorporation to change the name of the Company. In addition, to avoid the necessity of convening a shareholder meeting for a continuous investment program forany future name change, all Fund shareholders are being asked

to approve an amendment to the Funds.Articles of Incorporation to permit the Board to approve changes in the name of the Company without first seeking shareholder approval. For the reasons explained in detail in the accompanying proxy statement (the “Proxy Statement”),GEAMSSGA FM and the Board of Directors of the Company (the “Board”) recommend that you vote in favor of each Proposal applicable to your Fund, as noted below.the Proposals.

For all Fund shareholders:

For Small-Cap Equity Fund shareholders:

For Real Estate Securities Fund shareholders:

For Total Return Fund shareholders:

Shareholders of the S&P 500 Index Fund should note that they are not being asked to approve a new sub-advisory agreement for the Fund. SSGA FM currently serves as sub-adviser of the S&P 500 Index Fund. While the current sub-advisory agreement with respect to the S&P 500 Index Fund will terminate as a result of the Transaction, shareholders are being asked to approve a new investment advisory and administration agreement with SSGA FM pursuant to Proposal 1. If approved, SSGA FM will become the investment adviser and administrator to the S&P 500 Index Fund and the Fund will not retain a sub-adviser.

It is expected that the personnel providing investment advisory services to the Funds will not change as a result of the Transaction. Upon the closing the Transaction, it is expected that the existing GEAM team will become employees of SSGA FM and its affiliates, with the same individuals at GEAM currently investing assets on behalf of the Funds doing so as part of SSGA FM in order to facilitate a seamless transition of the portfolio management services provided.

Therethere will be no change in your share ownership in the Funds, nor will there be any change in the investment objective or policies of any Fund in connection with the Transaction.Fund. The Funds will not bear the cost of this proxy solicitation. GEAMSSGA FM will bear the cost of this proxy solicitation.

2

Please note that consummation of the Transaction is subject to various conditions, as described more fully in the enclosed Proxy Statement. If the Transaction is not consummated, none of the Proposals, if approved, will be implemented.

The enclosed Proxy Statement explains the Proposals to be considered in greater detail. Please read it carefully. Although we hope that you can attend the Meeting in person, we urge you in any event to vote your shares at your earliest convenience in order to make sure that you are represented at the Meeting.

As an owner of a variable contract your insurance company holds shares of one or more Funds on your behalf. Although you are not a shareholder of the Funds, you have the right to instruct your insurance company on how to vote Fund shares corresponding to your investment through your variable contract.

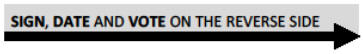

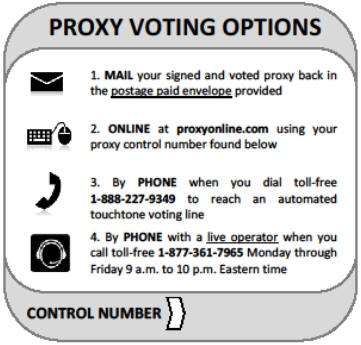

To ensure that your instructions are counted, please:

Thank you for your prompt attention to this matter. If you have any questions about the Proposals, please contact our proxy information linetoll-free at 1-877-361-7965.

Sincerely,

/s/ Jeanne M. LaPortaLa Porta

Jeanne M. LaPortaLa Porta

President of GE Investments Funds, Inc.

3

GE INVESTMENTS FUNDS, INC.

U.S. EQUITY FUND

PREMIER GROWTH EQUITY FUND

SMALL-CAP EQUITY FUND

S&P 500 INDEX FUND

CORE VALUE EQUITY FUND

INCOME FUND

TOTAL RETURN FUND

REAL ESTATE SECURITIES FUND

1600 Summer Street

Stamford, Connecticut 06905

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON [●],NOVEMBER 2, 2016

To owners of variable life insurance contracts and variable annuity contracts (each, a “variable contract”) issued by Genworth Life and Annuity Insurance Company, Genworth Life Insurance Company of New York, Pacific Life Insurance Company, or Transamerica Life Insurance Company (collectively, the “Insurance Companies”) entitled to give voting instructions in connection with certain separate accounts established by the Insurance Companies:

A special meeting of the shareholders (the “Meeting”) of each of the funds listed above (each, a “Fund,” and collectively, the “Funds”), each a series of GE Investments Funds, Inc. (the “Company”), will be held at 1600 Summer Street, Stamford, Connecticut 06905 on [●],November 2, 2016 at [●]10:00 a.m. (Eastern Time), or at any adjournment(s) or postponement(s) thereof, for the following purposes:

For all FundsFunds::

For Small-Cap Equity Fund shareholders:

(collectively, the “Small-Cap Equity FundSub-Advisers”) (Proposals 4A to 4E)

For Real Estate Securities Fund shareholders:

For Total Return Fund shareholders:

Separate accounts of the Insurance Companies are the only shareholders of the Funds. However, the Insurance Companies hereby solicit instructions for voting shares of the Funds attributable to their separate accounts from owners of variable contracts having contract values allocated to such separate accounts invested in such shares as of the Record Date (as defined below) and agree to vote such shares at the Meeting in accordance with such instructions received in a timely manner.

Shareholders of the S&P 500 Index Fund should note that they are not being asked to approve a new sub-advisory agreement for the Fund. SSGA FM currently serves as sub-adviser of the S&P 500 Index Fund. While the current sub-advisory agreement with respect to the S&P 500 Index Fund will terminate as a result of the Transaction, shareholders are being asked to approve a new investment advisory and administration agreement with SSGA FM pursuant to Proposal 1. If approved, SSGA FM will become the investment adviser and administrator to the S&P 500 Index Fund and the Fund will not retain a sub-adviser.

The Board of Directors has fixed April 22,August 31, 2016 as the record date (the “Record Date”) for the determination of shareholders entitled to notice of and to vote at the Meeting, or at any adjournment(s) or postponement(s) thereof. As a variable contract owner of record at the close of business on April 22,August 31, 2016, you have the right to instruct your Insurance Company as to the manner in which shares of a Fund attributable to your variable contract should be voted. A Proxy Statement is attached to this Notice that describes the matters to be voted upon at the Meeting or any adjournment(s) or postponement(s) thereof, and a ProxyVoting Instruction Card is enclosed for you to provide your voting instructions to your Insurance Company.

Your voting instructions on these proposals are important. Please provide your voting instructions as soon as possible to save the expense of additional solicitations. You can vote quickly and easily by completing and

mailing the enclosed ProxyVoting Instruction Card, or by telephone or on the Internet.internet. Please follow the instructions that appear on your enclosed ProxyVoting Instruction Card to ensure your voting instructions are properly and timely recorded.

2

Copies of the Company’s most recent Annual Report and Semi-Annual Report to shareholders are available on the Company’s website atwww.geam.com/prospectus or will be furnished without charge, upon request, by writing to the Company at 1600 Summer Street, Stamford, Connecticut 06905, Attn: Mutual Fund Services, or by calling1-800-352-9910 (for Genworth Life and Annuity Insurance Company), 1-800-313-5282 (for Genworth Life Insurance Company of New York), 1-800-722-4448 (for Pacific Life Insurance Company), or1-800-525-6205 (for Transamerica Life Insurance Company).

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to be Held on [●],November 2, 2016:

This Proxy Statement is available on the internet atwww.proxyweb.comhttps://proxyonline.com/docs/ssga/.

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE IN FAVOR OF EACH PROPOSAL.

By Order of the Board of Directors

/s/ JoonWonJoon Won Choe

JoonWonJoon Won Choe

Secretary

Stamford, Connecticut

[●],September 23, 2016

3

ii

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

iii

GE INVESTMENTS FUNDS, INC.

U.S. EQUITY FUND

PREMIER GROWTH EQUITY FUND

SMALL-CAP EQUITY FUND

S&P 500 INDEX FUND

CORE VALUE EQUITY FUND

INCOME FUND

TOTAL RETURN FUND

REAL ESTATE SECURITIES FUND

PROXY STATEMENT

For a Special Meeting of Shareholders

on [●],November 2, 2016

General

What is the purpose of the Meeting?

This Proxy Statement is being furnished on behalf of the Board of Directors (the “Board”) of GE Investments Funds, Inc. (the “Company”) by Genworth Life and Annuity Insurance Company, Genworth Life Insurance Company of New York, Pacific Life Insurance Company, and Transamerica Life Insurance Company (collectively, the “Insurance Companies”) to owners of variable annuity contracts and variable life insurance contracts (together, the “variable contracts”) issued by the Insurance Companies and having contract values on April 22,August 31, 2016 (the “Record Date”) allocated to sub-accounts of certain separate accounts (the “Separate Accounts”) of the Insurance Companies that are invested in shares of the U.S. Equity Fund, Premier Growth Equity Fund, Small-Cap Equity Fund, S&P 500 Index Fund, Core Value Equity Fund, Income Fund, Total Return Fund and Real Estate Securities Fund (each, a “Fund,” and collectively, the “Funds”), each an investment portfolio of the Company.

The Board has called this special meeting of shareholders (the “Meeting”) to present severalthe following important proposalsproposals:

In Proposal 1, shareholders of all Funds are being asked to approve an amendment to the Articles of Incorporation of the Company, as amended and/or restated to date (the “Proposals”“Articles of Incorporation”), which relate to change the name of the Company.

In Proposal 2, shareholders of all Funds are being asked to approve an amendment to the Articles of Incorporation to permit the Board to change the name of the Company without seeking shareholder approval.

This Proxy Statement provides additional information about the Proposals.SSGA Funds Management, Inc. (“SSGA FM”), the investment adviser to the Funds, and the Board recommend that you vote in favor of each Proposal. This Proxy Statement and related proxy materials will be first made available to shareholders on or about September 30, 2016.

What Proposals will each shareholder (and variable contract owner) be asked to vote on?

Shareholders of all Funds will be asked to vote on each Proposal. For each Proposal, shareholders of all Funds will vote together and not by Fund or share class.

1

Proposal 1: Changing the Name of the Company

Why are shareholders being asked to approve a change in the name of the Company?

Proposal 1 relates to the rebranding of the Company in connection with the asset purchase agreement entered into on March 29, 2016 by General Electric Company (“GE”) with State Street Corporation (“SSC”) for the sale of the asset management and advisory services business conducted by GE Asset Management Incorporated (“GEAM”), a wholly owned subsidiary of GE and the Funds’ investmentthen-investment adviser, and certain of its subsidiaries (the “Transaction”). The Transaction is expected to close in the third quarter of 2016 pending receipt of certain regulatory approvals and subject to satisfaction of other customary closing conditions. Pursuant toIn connection with the Transaction, SSGA Funds Management, Inc. (“SSGA FM” or the “Adviser”), an affiliateat a special meeting of SSC, will acquire the rights, title and interest in certain assets, and assume certain liabilities of GEAM.GEAM and the Board recommend that you vote in favor of each Proposal applicable to your Fund. This Proxy Statement and related proxy materials will be first made available to shareholders on or about [●], 2016.

In Proposal 1, shareholders of each Fund are being asked to approve anthe Funds held on June 22, 2016, the shareholders approved, among other proposals, a new investment advisory and administration agreement (each afor each Fund with SSGA FM, an affiliate of SSC (the “New Investment Advisory and Administration Agreement”Agreements”) for their respective Fund, pursuant to which SSGA FM will replacereplaced GEAM as investment adviser and administrator to each Fundthe Funds upon consummation of the Transaction. Under the laws governing U.S. mutual funds, a mutual fund investment advisory agreement is required to provide for its automatic termination upon its “assignment” (as defined in the Investment Company Act of 1940 (the “1940 Act”)). Thus, by their terms, the current investment advisory and administration agreements under which GEAM provides investment advisory services to the Funds (the “Existing GEAM Agreements”) will automatically terminate upon consummation of the Transaction. Accordingly, shareholders of each Fund are being asked to approve a new investment advisory and administration agreement with the AdviserTransaction on substantially similar terms as the Existing GEAM Agreements. The differences in terms between the New Investment Advisory and Administration Agreement and the Existing GEAM Agreements are described in additional detail in Proposal 1. This joint proxy statement of the Funds (the “Proxy Statement”) provides additional information about the Transaction and the new investment advisory and administration agreement. July 1, 2016.

The Board believes that approval of the new agreementit is important to provide continuity of the high quality investment advisory services that your Fund has received in the past.

1

In Proposal 2, shareholders of the Funds are being asked to approve the election of Directors to the Board. Each of the nominees currently serves as a Director of the Company. Shareholders are being asked to approve the election of the nominees in order to ensure ongoing compliance with applicable provisions of the 1940 Act in connection with the Transaction.

In Proposal 3, shareholders of the Funds are being asked to approve manager-of-managers authority for SSGA FM. GEAM currently manages the assets of certain Funds using a manager-of-managers approach under which GEAM may allocate some or allthere be broad recognition of the Funds’ assets among one or more specialist sub-advisers. GEAM exercisesrelationship with their investment adviser. In this authority in accordanceregard, historically, and consistent with a common industry practice, the terms of an exemptive order from the Securities and Exchange Commission (the “SEC”) that enables GEAM, subject to approvalname of the Board,Company has reflected the name of the investment adviser to enter into and materially amend sub-advisory agreements with unaffiliated sub-advisers without shareholder approval.the Funds. Given that SSGA FM also has obtained an exemptive order from the SEC that is substantially similarreplaced GEAM as investment adviser to the exemptive order under which GEAM exercises manager-of-managers authority. If manager-of-managers authority is approved by a Fund’s shareholders foreach Fund, SSGA FM determined that it would be appropriate for the name of the Company to reflect its affiliation with SSGA FM, may, subjectthe Funds’ new investment adviser, by changing the Company’s name to Board approval, enter into and materially amend investment sub-advisory agreements with unaffiliated sub-advisers for the Fund without obtaining shareholder approval in each case. If approved by the relevant Fund’s shareholders, SSGA FM is expected to enter into sub-advisory agreements that will continue (i) the Small-Cap Equity Fund’s current sub-advisory arrangements with each of Palisade Capital Management, LLC; Champlain Investment Partners, LLC; GlobeFlex Capital, L.P.; Kennedy Capital Management,State Street Variable Insurance Series Funds, Inc.; and SouthernSun Asset Management LLC (collectively, the “Small-Cap Equity Fund Sub-Advisers”), (ii) the Real Estate Securities Fund’s current sub-advisory arrangement with CenterSquare Investment Management, Inc. (“CenterSquare” or the “Real Estate Securities Fund Sub-Adviser”) and (iii) the Total Return Fund’s current sub-advisory arrangement with BlackRock Investment Management, LLC (“BlackRock or the “Total Return Fund Sub-Adviser” and, together with the Small-Cap Equity Fund Sub-Advisers and CenterSquare, the “Existing Sub-Advisers”), each of which will automatically terminate upon its contractual terms upon the closing of the Transaction.

In Proposals 4A-4E, shareholders of the Small-Cap Equity Fund are being asked to approve new sub-advisory agreements between SSGA FM and each Small-Cap Equity Fund Sub-Adviser (each, a “New Small-Cap Sub-Advisory Agreement”) in order to ensure that the Small-Cap Equity Fund continues to receive investment sub-advisory services in the event shareholders do not grant SSGA FM manager-of-managers authority with respect to the Small-Cap Equity Fund. The New Small-Cap Sub-Advisory Agreements will continue the sub-advisory arrangements with the Small-Cap Equity Fund Sub-Advisers subsequent to the termination of each Small-Cap Equity Fund Sub-Adviser’s current sub-advisory agreement with respect to the Fund as As a result, of the Transaction. All material terms of the existingsub-advisory agreements with the Small Cap Equityall Fund Sub-Advisers will remain substantially unchanged, except as described below under Proposals 4A-4E.

In Proposal 5, shareholders of the Real Estate Securities Fund are being asked to approve a newsub-advisory agreement for the Real Estate Securities Fund with CenterSquare (the “New Real Estate Sub-Advisory Agreement”) in order to ensure that the Real Estate Securities Fund continues to receive investment sub-advisory services in the event shareholders do not grant SSGA FM manager-of-managers authority with respect to the Real Estate Securities Fund. The New Real Estate Sub-Advisory Agreement will continue the Real Estate Securities Fund’s sub-advisory arrangement with CenterSquare subsequent to the termination of Centersquare’s current sub-advisory agreement with respect to the Fund as a result of the Transaction. All material terms of the existing sub-advisory agreement will remain unchanged, except as described below under Proposal 5.

In Proposal 6, shareholders of the Total Return Fund are being asked to approve a new sub-advisory agreement for the Total Return Fund with BlackRock (the “New Total Return Sub-Advisory Agreement” and, together with the New Small-Cap Sub-Advisory Agreements and the New Real Estate Sub-Advisory Agreement, the “New Sub-Advisory Agreements,” which, together with the New Investment Advisory and Administration Agreement, are referred to below as the “New Agreements”) in order to ensure that the Total Return Fund continues to receive investment sub-advisory services in the event shareholders do not grant SSGA FM manager-of-managers authority with respect to the Total Return Fund. The New Total Return Sub-Advisory Agreement will continue the Total Return Fund’s sub-advisory arrangement with BlackRock subsequent to the termination of BlackRock’s current sub-advisory agreement with respect to the Fund as a result of the Transaction. All material terms of the existing sub-advisory agreement will remain unchanged, except as described below under Proposal 6.

2

Shareholders of the S&P 500 Index Fund should note that they are not being asked to approve a new sub-advisory agreement for the Fund. SSGA FM currently serves as sub-adviser of the S&P 500 Index Fund. While the current sub-advisory agreement with respect to the S&P 500 Index Fund will terminate as a result of the Transaction, shareholders are being asked to approve a New Investment Advisory and Administration Agreement with SSGA FM pursuant to Proposal 1. If approved, SSGA FM will become investment adviser and administratoran amendment to the S&P 500 Index Fund andArticles of Incorporation to change the Fund will not retain a sub-adviser.

What Proposals will each shareholder (and variable contract owner) be asked to vote on?

The following table summarizesname of the Proposals and the Funds whose shareholders are being asked to vote with respect thereto. For each Proposal, shareholders will vote on aFund-by-Fund basis.Company.

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

Will changing the Transactionname of the Company benefit the shareholders?

The Board believes that the Funds and their shareholders would receive the following potential benefits from changing the Transaction:

3

Why are shareholders (and variable contract owners) being asked to approve the New Investment Advisory and Administration Agreement in Proposal 1 and the New Sub-Advisory Agreements in Proposals 4, 5 and 6?

A shareholder vote on Proposal 1, Proposals 4A to 4E, Proposal 5 and Proposal 6 is being sought because the Transaction involves the assignment by GEAM and certain of its subsidiaries to SSC of (i) the Existing GEAM Agreements and (ii) the current sub-advisory agreements between GEAM and (a) eachname of the Small-Cap Equity Sub-Advisers, (b) CenterSquare and (c) BlackRock. The laws governing U.S. mutual funds requireCompany. In particular, the name change will make clear that everySSGA FM has replaced GEAM as the investment advisory agreement (includingadviser to the Funds. This will eliminate any investment sub-advisory agreement) with a mutual fund provide for its automatic termination inpotential investor confusion as to the eventidentity of an “assignment” (as defined in the 1940 Act). Thus, in order to ensure that the Funds continue to receive investment advisory services, the Board is seeking approval from the Funds’ shareholders of the New Agreements. Under the New Investment Advisory and Administration Agreement, SSGA FM will replace GEAM asnew investment adviser and administrator to the Funds. Under the New Sub-Advisory Agreements, the Small-Cap Equity Fund will continue to be sub-advised by the Small-Cap Equity Fund Sub-Advisers, the Real Estate Securities Fund will continue to be sub-advised by CenterSquare and the Total Return Fund will continue to be sub-advised by BlackRock, each pursuant to new agreements between such sub-advisers and SSGA FM. SSGA FM will commence management of the S&P 500 Index Fund directly. The Board believes that approval of the New Agreements is important to provide continuity of the advisory and, where applicable,sub-advisory services your Fund has received in the past.make appropriate investment option selection easier for variable contract owners.

Why are shareholders (and variable contract owners)the Articles of Incorporation being askedamended to approve granting SSGA FM manager-of-managers authority in Proposal 3?change the Company’s name?

Like GEAM, SSGA FM has been granted an exemptive order by the SEC under which SSGA FM may, subject to approvalThe name of the Board, enter intoCompany is set forth in the Articles of Incorporation. Under applicable law, and materially amend sub-advisory agreements with unaffiliated sub-advisers for a fund it advises without obtaining shareholder approval in each case. This order is substantially similar to GEAM’s order. Both exemptive orders are subjectthe Articles of Incorporation, an amendment to the condition thatArticles of Incorporation is necessary to change the shareholdersCompany’s name. The Articles of each such fund approve the manager-of-managers authority before the first time it is exercised and follow certain other conditions. Shareholders previously approved GEAM’s use of manager-of-managers authority for certain of the Funds under the terms of an order substantially similar to the order granted to SSGA FM. If manager-of-managers authority is approved for SSGA FM, SSGA FM is expected to enter into sub-advisory agreements that will continue (i) the Small-Cap Equity Fund’ssub-advisory arrangementsIncorporation may only be amended with the Small-Cap Equity Fund Sub-Advisers, (ii) the Real Estate Securities Fund’s sub-advisory arrangements with CenterSquare and (iii) the Total Return Fund’s sub-advisory arrangements with BlackRock. The Board believes that approval of granting SSGA FM manager-of-managers authority is important to provide continuity of thesub-advisory services your Fund has received in the past.

What would happen if shareholders of a Fund do not approve a New Investment Advisory and Administration Agreement for the Fund?

The Board has approved an interim investment advisory and administration agreement with the Adviser for each Fund, on substantially similar terms as the Existing GEAM Agreements in the event that the Transaction closes and shareholders of a particular Fund have not yet approved a New Investment Advisory and Administration Agreement for that Fund. If a New Investment Advisory and Administration Agreement for a Fund is not approved within 150 days of the date on which the Transaction closes, the Board will take such action as it deems to be in the best interests of that Fund and its shareholders, which could involve the liquidation of the Fund and distribution of the Fund assets in kind, in cash or a combination of both.

4

What would happen if shareholders of a Fund do not approve manager-of-managers authority for SSGA FM or approve a New Sub-Advisory Agreement for the Small-Cap Equity Fund, the Real Estate Securities Fund or the Total Return Fund?

The Board has approved interim sub-advisory agreements with each of the Small-Cap Equity Fund Sub-Advisers for the Small-Cap Equity Fund, with CenterSquare for the Real Estate Securities Fund and with BlackRock for the Total Return Fund, each on substantially similar terms as the existing sub-advisory agreements, in the event that the Transaction closes and shareholders of those Funds have not yet approved either manager-of-managers authority for SSGA FM or the relevant New Sub-Advisory Agreements. If manager-of-managers authority is not approved for SSGA FM, shareholders would need to specifically approve each sub-adviser for any of the Funds, including the Small-Cap Equity Fund, the Real Estate Securities Fund and the Total Return Fund. If shareholders do not approve either manager-of-managers authority or the New Sub-Advisory Agreements within 150 days of the date on which the Transaction closes, the Board will take such action as it deems to be in the best interests of each Fund and its shareholders, including, potentially, with respect to the Small-Cap Equity Fund, allocating the assets of the Fund among the Adviser and/or those Small-Cap Equity Fund Sub-Advisers with a New Sub-Advisory Agreement approved by the Fund’s shareholders, or, with respect to each of the Funds, liquidating the Fund and distributing the Fund assets in kind, in cash or a combination of both, if other options are determined not to be prudent or practicable.

Why are shareholders (and variable contract owners) not being asked to approve a new sub-advisory agreement for the S&P 500 Index Fund?

Shareholders of the S&P 500 Index Fund are not being asked to approve a new sub-advisory agreement for the S&P 500 Index Fund because SSGA FM currently serves as sub-adviser of the S&P 500 Index Fund. While the current sub-advisory agreement with respect to the S&P 500 Index Fund will terminate as a result of the Transaction, shareholders are being asked to approve a New Investment Advisory and Administration Agreement with SSGA FM pursuant to Proposal 1. If approved, SSGA FM will become investment adviser and administrator to the S&P 500 Index Fund and the Fund will no longer retain a sub-adviser.shareholder approval.

How will changing the Transactionname of the Company affect me as a Fund shareholder (and variable contract owner)?

FollowingThe name change will not affect the Transaction, each Fundvalue of your investment in which you invest will be advised by the SSGA FM, rather than GEAM.Funds. You will continue to be a shareholder ofan investor in your Fund, and its investment objective and policies will not change as a result of changing the Transaction.Company’s name.

Proposal 2: Permitting the Board to Approve Future Name Changes Without Shareholder Approval

Why are shareholders being asked to permit future name changes with Board approval but without shareholder approval?

Under the Articles of Incorporation, the Board is required to obtain shareholder approval for a change in the name of the Company. This requirement hinders the Board’s ability to efficiently act in situations where a name change would be appropriate. The New Investment Advisoryamendment would provide the Board with flexibility to react quickly to future contingencies that may make it necessary or advisable to change the name of the Company (such as those

2

contemplated in Proposal 1), without causing the Funds to incur the expense and Administration Agreement is substantially similarpotential delay of soliciting shareholder approval.

How will permitting future name changes with Board approval but without shareholder approval affect me as a Fund shareholder (and variable contract owner)?

The Board’s additional flexibility to accommodate future name changes without incurring the delay and expenses of holding a shareholder meeting will not alter in any way the Board’s existing fiduciary duties to the Existing GEAM Agreements, except forFunds.

Other Information

What would happen if shareholders do not approve a Proposal?

In the identityevent that a Proposal is not approved by shareholders at the Meeting, the Articles of the Adviser andIncorporation will remain as described further below, and each New Sub-Advisory Agreement is substantially similar to its corresponding existing agreement. In addition, the Adviser does not contemplate instituting any fundamental changes to the manner in which GEAM has historically operated its businessthey currently exist with respect to providing advisory and related ancillary services to the Funds. It is intended that the same portfolio managers will continue to manage the Funds in accordance with the same investment objectives and policies.

How do the proposed New Investment Advisory and Administration Agreement and New Sub-Advisory Agreements differ from the current arrangements in non-fee terms?

The terms and conditions of the New Investment Advisory and Administration Agreement is substantially similar to those of the Existing GEAM Agreements, except that the New Investment Advisory and Administration Agreement (i) clarifies the Adviser’s responsibility with respect to the selection and oversight of sub-advisers, (ii) with respect to the Adviser’s use of “soft dollar” arrangements, more clearly states the standard set out under Section 28(e) of the Securities Exchange Act of 1934, (iii) designates the Commonwealth of Massachusetts as the governing law of the agreementsProposal and the exclusive forum for actions arising underBoard will take such action as it deems to be in the agreements and (iv) clarifies that there are no third-party beneficiaries to the agreements. With the exceptionbest interest of the S&P 500 Index Fund, the Adviser is not expecting to change the net amounts of the combined fee for investment advisory and administrative services that is accrued daily and paid monthly by each Fund (each, a “Management Fee”) under the New Investment Advisory and Administration Agreement. The Adviser is proposing to lower the combined Management Fee of the S&P 500 Index Fund from 35 basis points to 25 basis points. The Board believes continuing the advisory arrangements will be beneficial to the Funds and their shareholders, by, among other things, offering the continued abilitywhich may include calling a second meeting of shareholders to benefit from the expertise of the same portfolio managers of GEAM currently managing the Funds.

5

In addition, the terms and conditions of the New Sub-Advisory Agreements are substantially the same as those under the current arrangements. The differences between the agreements are described below under Proposals 4-6. There will be no change in sub-advisory fees under the New Sub-Advisory Agreements. The Board believes continuing thesub-advisory arrangements will be beneficial to the Funds and their shareholders by, among other things, offering the continued ability to benefit from the expertise of the same portfolio managers of the Existing Sub-Advisers currently managing the Funds.

Will the Adviser, Existing Sub-Advisers and the portfolio managers remain the same?

Yes. Upon consummation of the Transaction, and subject to shareholder approval, the same portfolio managers are expected to continue to manage the Funds. Looking ahead, you can expect the same level of management expertise and high quality service to which you’ve grown accustomed as a shareholder of the Funds.

Why are shareholders (and variable contract owners) being asked to approve the election of Directors to the Board of each Fund in Proposal 2?

Two of the nominees, Donna M. Rappaccioli and Jeanne M. La Porta, were appointed to serve as Directors by action of the Board in 2012 and 2014, respectively. However, they have not yet been considered for servicevote on the Board by the shareholders. Accordingly, the Board nominates Ms. Rappaccioli and Ms. La Porta for your consideration to serve as members of your Board. The Board also nominates John R. Costantino and R. Sheldon Johnson for your consideration to continue to serve as members of the Board of each Fund. Mr. Costantino and Mr. Johnson have already been approved by the shareholders in 1997 and 2011, respectively. Each of Ms. Rappaccioli and Messrs. Costantino and Johnson are not “interested persons” (as defined in the 1940 Act) of the Funds, GEAM or the Adviser (“Independent Directors”). Ms. La Porta currently serves as an “Interested Director” as she is an “interested person” (as defined in the 1940 Act) of the Funds as a result of her role with GEAM.

The safe harbor of Section 15(f) of the 1940 Act permits an investment adviser of a registered investment company (or any affiliated persons of the investment adviser) to receive an amount or benefit in connection with a sale of securities or other interest in the investment adviser, provided that certain conditions are satisfied. Among other conditions, the safe harbor requires that at least 75% of the members of the investment company’s board cannot be “interested persons” (as defined in the 1940 Act) of the investment adviser or its predecessor during the three-year period after the sale. At the closing of the Transaction, it is proposed that Mr. Costantino, Mr. Johnson and Ms. Rapaccioli will continue to serve as Independent Directors of the Funds, and Ms. La Porta will serve as an Interested Director of the Funds as a result of her anticipated role with the Adviser.Proposal.

Does the approval of anyone Proposal depend on the approval of anythe other Proposals or other events?Proposal?

No. Shareholders will vote on each Proposal separately by Fund. The approval of Proposals 4A-4E for the Small-Cap Equity Fund, Proposal 5 for the Real Estate Securities Fund and Proposal 6 for the Total Return Fund are contingent upon the approval of Proposal 1 for each of those Funds.separately. The approval of Proposal 3 for a Fund is contingent upon the approval of Proposal 1 for that Fund. The approval of Proposals 1 and 2 for a Fund is not contingent upon the approval of any other Proposal for2. The approval of Proposal 2 is not contingent upon the approval of Proposal 1. In the event that Fund. The implementation of eachshareholders approve Proposal is contingent on2, but not Proposal 1, the consummationBoard would be authorized to change the name of the Transaction.Company to State Street Variable Insurance Series Funds, Inc. without shareholder approval.

Will my Fund pay for this proxy solicitation or for the costs of the Transaction?solicitation?

No. The Funds will not bear these costs. GEAMSSGA FM will bear all normal and customary fees and expenses in connection with the TransactionProposals (including, but not limited to, proxy and proxy solicitation costs, printing costs Directors’ fees relating to the special Board meetings and legal fees).

THE BOARD OF EACH FUNDUNANIMOUSLY RECOMMENDS THAT YOU VOTE

IN FAVOR

OF EACH OF THE PROPOSALS.

63

The Company is a Virginia corporation organized on May 14, 1984, and is registered with the SECSecurities and Exchange Commission (the “SEC”) as an open-end management investment company under the Investment Company Act of 1940, Act.as amended (the “1940 Act”).

The Separate Accounts are the only shareholders of record of the Funds. Each Separate Account is a segregated asset account established by an Insurance Company. Certain Separate Accounts are registered with the SEC under the 1940 Act as unit investment trusts, whereas other Separate Accounts are excluded from the definition of “investment company” for purposes of the 1940 Act and therefore are not registered with the SEC under the 1940 Act. Net premiums paid by a variable contract owner may be allocated to one or more of the sub-accounts of each Separate Account that invest in shares of the Funds.

Each Insurance Company will vote the shares of the Funds held by its Separate Accounts at the Meeting in accordance with timely instructions received from persons entitled to give voting instructions under the variable contracts. All properly executed ProxyVoting Instruction Cards received by the issuing Insurance Company by the close of business on [●]November 1, 2016 will be counted for purposes of voting at the Meeting.

The number of shares of capital stock in a Fund for which a variable contract owner may give voting instructions is equal to the number of shares, or fraction of shares, held in the Separate Account attributable to the owner’s variable contract on the Record Date. Each share of such outstanding capital stock is entitled to one vote, and fractional votes are counted.

Each Insurance Company will vote shares attributable to variable contracts as to which no voting instructions are received in proportion (for, against, or abstain) to those for which instructions are received. If an executed ProxyVoting Instruction Card is received but does not specify a choice as to one or more Proposals, each Insurance Company will consider its timely receipt as an instruction to vote in favor of the Proposal(s). Consistent with the foregoing, voting instructions with respect to a Proposal to abstain and broker “non-votes” (voting instructions from brokers or other nominees indicating that they have not received instructions from the owner or other persons entitled to give voting instructions) will effectively be votes against the Proposal. In certain circumstances, an Insurance Company has the right to disregard voting instructions from certain variable contract owners, although GEAMSSGA FM is not aware that any Insurance Company believes that these circumstances exist with respect to the matters to be voted on at the Meeting.

The Insurance Companies do not require that a specified number of variable contract owners submit voting instructions before the Insurance Companies will vote the shares of a Fund held by their respective Separate Accounts at the Meeting. Therefore, a small number of variable contract owners may determine whether a Proposal is approved. In determining to vote the shares of a Fund held by its Separate Accounts at the Meeting, an Insurance Company, in its sole discretion, may consider such factors as (1) the percentage of votes represented by voting instructions received by the Insurance Company, and (2) the percentage of variable contracts represented by voting instructions received by the Insurance Company. When such determination has been made, the Insurance Company will vote the shares of the Fund held by its Separate Accounts as outlined in the paragraph above. In the unlikely event that an Insurance Company determines not to vote the shares of a Fund held by its Separate Account, the Insurance Company may re-solicit instructions for voting shares of such Fund from the variable contract owners having contract values allocated to such Separate Account.

4

Solicitation of Voting Instructions

Voting instructions are being solicited primarily by mail. Additional solicitations may be made by telephone or facsimile by officers or other employees of SSGA FM or its affiliates, and/or officers or other employees of an Insurance Company or its affiliates, who will not be separately compensated for such activities. The cost of theany such additional solicitation will be borne by each Insurance Company.SSGA FM.

NotwithstandingD.F. King & Co., Inc. (“D.F. King”) has been retained to assist in the foregoing, GEAM may engage Broadridge Financial Solutions, Inc.solicitation of proxies. D.F. King’s fees are estimated to make additional solicitationsbe $30,000 plus a reasonable amount to cover out-of-pocket expenses. D.F. King will provide certain project management services, including solicitation of voting instructions by telephoneand tabulation of votes. This fee estimate does not include legal expenses for preparing the proxy materials or facsimile.the costs of printing or mailing proxy materials or other miscellaneous related expenses. The anticipated costfees of such engagement is expectedD.F. King as well as all expenses related to be approximately [$●], which shall be borne by GEAM. The Funds will not bear the cost of this proxy solicitation. GEAM will also bear the cost of preparing, printing and mailing of the Proxy Statement and other proxy materials includingwill also be borne by SSGA FM, the solicitationtotal cost of voting instructions from variable contract owners.which is estimated to be $120,000.

7

Variable contract owners have three options for submitting voting instructions:

| 1. | Internet—the enclosed |

| 2. | Telephone—the enclosed |

| 3. | Mail—variable contract owners also may cast their votes by executing the enclosed |

The Insurance Companies and the Company encourage variable contract owners to vote via the internet or by telephone. Votes cast via the internet or over the telephone are recorded immediately and avoid the risk that postal delays will cause a ProxyVoting Instruction Card to arrive late and therefore not be counted.

Revocation of Voting Instructions

Variable contract owners may revoke their voting instructions at any time prior to the close of business on [●]November 1, 2016 by submitting a properly executed later-dated ProxyVoting Instruction Card or by submitting written notice to the Insurance Company that issued their variable contract or to the Secretary of the Company.

Each Fund currently has one class of shares outstanding, namely Class 1 shares, except for the Total Return Fund, which has two classes of shares outstanding, namely Class 1 and Class 4 shares, except for the Total Return Fund, which has three classes of shares outstanding, namely Class 1, Class 2, and Class 3 and the S&P 500 Index Fund has one class of shares outstanding, namely Class 1.shares. As of the Record Date, each of the Funds has the numbers of shares outstanding as set forth inExhibit A (“Outstanding Shares”), which, in each case equals the number of votes to which the shareholders of such Fund are entitled. As of the Record Date, there were no variable contract owners who beneficially owned a 5% or greater voting interest in any Fund, and officers and Directors of the Company, in the aggregate, beneficially owned (i.e., as owners of variable contracts) less than 1% of each Fund’s Outstanding Shares.

5

The presence, in person or by proxy, of the holders of one-third of the Outstanding Shares of a Fund constitutes a quorum for the Meeting for that Fund with respect to Proposals 1, 3, 4A to 4E, 5 and 6. With respect to Proposal 2 (Election of Directors), the presence in person or by proxy of the holders of one-third of the Outstanding Shares of the Company constitutes a quorum for the Meeting. However, because the Separate Accounts are the holders of record of all the Outstanding Shares, the Company expects all of the Outstanding Shares to be present at the Meeting.

If a quorum is present at the Meeting, theThe approval of Proposals 1, 3, 4A to 4E, 5 and 6 for a Fund (as applicable)each Proposal requires the affirmative vote of a “majority of the outstanding voting securities” of that Fund, which means the affirmative vote of the lesser of: (1) more than 50%holders of a majority of the Outstanding Shares of that Fund,the Company present in person or (2) 67% or more of the Outstanding Shares of that Fund presentby proxy at the Meeting, (in person or represented by proxy), if the holders of more than 50% of the Outstanding Shares ofprovided that Fund are present at the Meeting. The approval ofa quorum is present. For each nominee proposed in Proposal, 2 requires a plurality of all Outstanding Shares of the Company voting, meaning that to be elected, a nominee must be one of the four nominees receiving the most “FOR” votes because the four nominees receiving the most “FOR” votes (even if less than a majority of the votes cast) will be elected. Each Proposal will be voted on separately. All Outstanding Shares of each Fund will vote in the aggregate as one class, and not by

8

class of shares, on Proposals 1, 3, 4A to 4E, 5 and 6, as applicable, with each Fund voting separately. With respect to Proposal 2, all Outstanding Shares of the Company will vote together and not by Fund. The approval ofEach Proposal 3 for each Fund, 4A to 4E for the Small-Cap Equity Fund, Proposal 5 for the Real Estate Securities Fund and Proposal 6 for the Total Return Fund are each contingent upon the approval of Proposal 1 for that Fund. The approval of Proposals 1 and 2 for a Fund is not contingent upon the approval of any other Proposal for that Fund.will be voted on separately.

With regard to Proposals 1, 3, 4A to 4E, 5 and 6, votesVotes may be cast IN FAVOR OF or AGAINST each Proposal, or a variable contract owner may ABSTAIN from voting. With regard to Proposal 2, votes may be cast FOR one or all of the nominees, or the authority to vote may be WITHHELD with respect to one or all of the nominees.

In determining whether shareholders have approved a Proposal, brokernon-votes, votes that are withheld, and abstentions will be treated as shares present at the Meeting for establishing a quorum but that have not been voted. Accordingly, assuming the presence of a quorum, brokernon-votes and abstentions effectively will be votes “AGAINST” Proposals 1, 3, 4A to 4E, 5 and 6 because each such Proposal requires the affirmative vote of a “majority of the outstanding voting securities” of a Fund. Abstentions, votes that are withheld, and brokernon-votes will be deemed not to be votes cast at the Meeting and thus will have no effect on Proposal 2; each nominee will be elected by a plurality of the votes cast at the Meeting.Proposal.

It is possible that a Fundthe Company may propose to the Insurance Companies one or more adjournmentsadjournment(s) or postponementspostponement(s) of the Meeting. The chairman of the Meeting may adjournAny such adjournment or postpone the Meeting. The question of adjournments may also be (but is not required to be) submitted topostponement will require an affirmative vote of the shareholders, and in that case, any adjournment with respect to one or more matters must be approved by the voteholders of a majority of the votes castOutstanding Shares of the Company present in person or by proxy at the Meeting with respect to the matter or matters adjourned, whether or not a quorum is present with respect to such matter or matters, and if approved, such adjournment shall take place without the necessity of further notice. Any shares present and entitled to vote at the Meeting may, at the discretion of the proxies named therein, be voted in favor of such an adjournment.Meeting. Each Insurance Company will vote upon such adjournment or postponement after consideration of the best interests of all owners of its variable contracts invested in the Funds.

96

Proposal 1

APPROVAL OF NEW INVESTMENT ADVISORY AND ADMINISTRATION AGREEMENT WITHAN AMENDMENT TO THE ADVISERARTICLES OF INCORPORATION

TO CHANGE THE NAME OF THE COMPANY

GE INVESTMENTS FUNDS, INC.

U.S. EQUITY FUND

PREMIER GROWTH EQUITY FUND

SMALL-CAP EQUITY FUND

S&P 500 INDEX FUND

CORE VALUE EQUITY FUND

INCOME FUND

TOTAL RETURN FUND

REAL ESTATE SECURITIES FUND

At the Meeting, you will be asked to approve new investment advisory and administration agreementan amendment to enablethe Articles of Incorporation to change the name of the Company from GE Investments Funds, Inc. to State Street Variable Insurance Series Funds, Inc. Proposal 1 relates to the rebranding of the Company to reflect the replacement of GEAM by SSGA FM to replace GEAM as investment adviser and administrator to the Funds. A general description of the New Investment Advisory and Administration Agreement and a comparison of the agreements with the existing arrangements are included below. While the New Investment Advisory and Administration Agreement will be voted on Fund by Fund this Proposal 1 contemplates the execution of a single agreement to which each Fund separately will become a party, if approved by shareholders. The New Investment Advisory and Administration Agreement to which each Fund would become a party is attached hereto asExhibit C.

A shareholder vote is being sought because the Transaction involves the assignment by GEAM and certain of its subsidiaries to SSC of GEAM’s investment advisory and administration agreements with the Funds. The laws governing U.S. mutual funds require that every investment advisory agreement with a mutual fund provide for its automatic termination in the event of an “assignment” (as defined in the 1940 Act). Thus, in order to ensure that the Funds continue to receive investment advisory services, the Board is seeking approval from the Funds’ shareholders of the New Investment Advisory and Administration Agreement.

The Transaction does not affect the amount of shares you own or the total management fees charged to the Funds. The Adviser will serve as the Funds’ investment adviser and administrator on terms that are substantially similar to the Funds’ existing arrangements. In addition, it is intended that the same portfolio managers will continue to manage the Funds in accordance with the same investment objectives and policies. The Board’s rationale for approving the New Investment Advisory and Administration Agreement is discussed in greater detail below under “Matters Considered by the Board.”

On March 29, 2016, GE entered into an asset purchase agreement with SSC for the sale of the asset management and advisory services business conducted by GEAM and certain of its subsidiaries. The Transaction alignsaligned with GE’s plan to simplify its financial business platform, while providing GE with the ability to generate value from the strong investment management division it has built. At the same time, the Transaction would allowallowed GEAM to combine its valuable capabilities and resources with a premier asset manager such as the Adviser,SSGA FM, with the scale and distribution capabilities that would help the mutual fund platforms to grow.

The Transaction is expected to close in the third quarter of 2016 pending receipt of certain regulatory approvals and subject to satisfaction of other customary closing conditions. Pursuant to In connection with the Transaction, SSGA FM will acquire the rights, title and interest in certain assets, and assume certain liabilities, of GEAM.

SSGA FM is a global leader in asset management that sophisticated institutions worldwide rely on for their investment needs. SSGA FM is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940 and is a wholly-owned subsidiary of SSC, a publicly traded financial holding company. SSGA FM was established in 2001.

10

SSGA FM’s investment advisory clients consist primarily of U.S. investment companies registered under the 1940 Act and certain pooled investment vehicles exempt from registration under the 1940 Act, for which SSGA FM is either the named investment adviser or sub-adviser. SSGA FM works with its clients to provide customized solutions to their investment management needs, which may include customized indices, model portfolios, and screened portfolios.

SSGA FM provides asset allocation models on a non-discretionary basis and related investment advice to investment advisers and other financial institutions that use such information provided by SSGA FM for use in or with various financial products offered to their clients. As of December 31, 2015, SSGA FM had $384,947,572,235 in regulatory assets under management on a discretionary basis in 258 advisory accounts.

A table detailing the name, address and principal occupation of the principal executive officers and each director of the Adviser can be found inExhibit D.

Background on the Existing GEAM Agreements

GEAM is the investment adviser and administrator of each Fund. GEAM is a wholly-owned subsidiary of GE and a registered investment adviser. As of December 31, 2015, GEAM had approximately $110 billion of assets under management, of which approximately $22 billion was invested in mutual funds.

The Board recently approved the Existing GEAM Agreements in accordance with its annual review process, at a regularly scheduled Boardspecial meeting on December 18, 2015.

Historical Fees

Each Fund pays GEAM a combined fee for investment advisory and administrative services that is accrued daily and paid monthly (each, a “Management Fee”). The Management Fee for the Real Estate Securities Fund declines incrementally as Fund assets increase. This means that investors pay a reduced fee with respect to Fund assets over a certain level, or “breakpoint.”

Under a separate sub-administration agreement, GEAM has delegated certain administrative functions to State Street Bank and Trust Company, One Lincoln Street, Boston, Massachusetts 02111 (“State Street Bank”). Under the sub-administration agreement, State Street Bank performs certain back office services to support GEAM including, among other things, furnishing financial and performance information about the Funds for inclusion in regulatory filings and Board and shareholder reports; preparing regulatory filings, Board materials and tax returns; performing expense and budgeting functions; performing tax compliance testing; and maintaining books and records. Upon the closing of the Transaction, the Adviser expects to continue the sub-administration arrangements for each Fund with State Street Bank on substantially similar terms as currently existing.

For the Funds that have retained sub-advisers to manage all or a portion of the respective Fund’s assets, GEAM pays each Existing Sub-Adviser an investment sub-advisory fee pursuant to a sub-advisory agreement (an “Existing Sub-Advisory Agreement”) with such Existing Sub-Adviser. The investment sub-advisory fee is paid by GEAM monthly and is based upon the value of the average daily net assets of the respective Fund’s assets that are allocated to and managed by the Existing Sub-Adviser.

Each Fund pays GEAM a Management Fee. The fee is accrued daily and paid monthly at the following rates:

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

11

For the fiscal year ended December 31, 2015, the Funds paid GEAM the following Management Fees as a percentage of average net assets:

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

From time to time, GEAM may waive or reimburse the Management Fee paid by a Fund.

Portfolio Management Teams

Each Fund is managed by either an individual portfolio manager who is primarily responsible for the day-to-day management of the Fund, or a team of portfolio managers, who are jointly and primarily responsible for theday-to-day management of the Fund. The portfolio managersshareholders of the Funds generally have final authority over all aspects of their portions of a Fund’s investment portfolio, including security purchase and sale decisions, portfolio construction techniques and portfolio risk assessment.

Aboutheld on June 22, 2016, the Sub-Advisers

GEAM has retained the Existing Sub-Advisers who are either (i) primarily responsible for the day-to-day management of the investment program for a Fund, or (ii) responsible for managing a portion of a Fund’s assets allocated to the Existing Sub-Adviser.

GEAM is responsible for allocating the Small-Cap Equity Fund’s assetsshareholders approved, among the Small-Cap Equity Fund Sub-Advisers and for managing the Fund’s cash position.

GEAM is responsible for allocating the Real Estate Securities Fund’s assets to CenterSquare, and for managing the Fund’s cash position.

GEAM is responsible for allocating the Total Return Fund’s assets to BlackRock, and for managing the Fund’s cash position.

Additional information about the Existing Sub-Advisers including the name, address and principal occupation of the principal executive officers and each director, as well as fees charged by the Existing Sub-Advisers to similar mutual funds can be found inExhibits H toN.

12

Material Terms ofother proposals, the New Investment Advisory and Administration Agreement

The following discussion is a description of the material terms of the New Investment Advisory and Administration Agreement. This description is qualified in its entirety by reference to the New Investment Advisory and Administration Agreement, which is attached asExhibit C to this Proxy Statement.

Investment Management Services.Under the New Investment Advisory and Administration Agreement, subject to the oversight and supervision of the Board with respect to each Fund the Adviser agrees to provide a continuous investment program for the Fund’s assets, including investment research and management. The Adviser will determine from time to time what investments will be purchased, retained or sold by the Fund. The Adviser will place purchase and sale orders for the Fund’s investments. The Adviser will, at its own expense, maintain sufficient staff, and employ or retain sufficient personnel and consult with any other persons that it determines may be necessary or useful to the performance of its obligations under this agreement. The Adviser will keep the Fund informed of developments materially affecting the Fund, and will, on its own initiative, furnish the Fund from time to time with whatever information and reports that the Board reasonably requests as appropriate for this purpose. The Adviser will also carry out certain supervisory services with respect to any sub-advisers appointed to the Fund.

Administrative Services. Subject to the oversight, supervision and direction of the Board, the Adviser agrees to serve as administrator to each Fund and, in this capacity, will: (i) insure the maintenance of the books and records of the Funds (including those required to be maintained or preserved by Rules 31a-1 and 31a-2 under the 1940 Act); (ii) prepare reports to shareholders of the Funds, (iii) prepare and file tax returns for the Funds; (iv) assist with the preparation and filing of reports and the Registration Statement with the SEC; (v) provide appropriate officers for the Company, including a Secretary or Assistant Secretary; (vi) provide administrative support necessary for the Board to conduct meetings; and (vii) supervise and coordinate the activities of other service providers to the Company, including independent auditors, legal counsel, custodians, accounting service agents, and transfer agents.

Compensation. Pursuant to the New Investment Advisory and Administration Agreement, each Fund will pay the same Management Fee rate as charged under the Existing GEAM Agreements except that the Management Fee rate payable by the S&P 500 Index Fund will be lowered to 0.25%.

The Company will pay the Adviser, with respect to each Fund, at the beginning of each calendar month, a fee calculated as a percentage of the value of the average daily net assets of the Fund during the previous month (as computed in accordance with the description of the determination of the net asset value in the currently effective prospectus for the Fund at the time of the computation) at the following annual rates:

Name of Fund | Current Management Fee (payable to | New Management Fee (payable to the | ||

Income Fund | 0.50% | 0.50% | ||

Total Return Fund | 0.35% | 0.35% | ||

Real Estate Securities Fund | 0.85% of the first $100,000,000; 0.80% of the next $100,000,000 and 0.75% of amounts in excess of $200,000,000 | 0.85% of the first $100,000,000; 0.80% of the next $100,000,000 and 0.75% of amounts in excess of $200,000,000 | ||

Value Equity Fund | 0.65% | 0.65% | ||

Small Cap Value Equity Fund | 0.95% | 0.95% | ||

U.S. Equity Fund | 0.55% | 0.55% | ||

Premier Growth Equity Fund | 0.65% | 0.65% | ||

S&P 500 Index Fund | 0.35% | 0.25% |

Expenses. Each Fund shall be responsible for payments of all expenses it may incur in its operation and all of its general administrative expenses except those expressly assumed by the Adviser in the New Investment Advisory and Administration Agreement. Fund expenses include, by way of description and not of limitation, any share redemption expenses, expenses of portfolio transactions, shareholder servicing costs, pricing costs (including the daily calculation of net asset value), interest on borrowings by the Fund, charges of the custodian and transfer agent, if any, cost of auditing services, non-interested directors’ fees, legal expenses, state franchise taxes, certain other taxes, investment advisory fees, certain insurance premiums, costs of maintenance of corporate existence, investor services (including allocable personnel and telephone expenses), costs of printing and mailing updated Fund prospectuses to shareholders, proxy statements and shareholder reports, the cost of paying dividends and capital

13

gains distribution, capital stock certificates, costs of Board and shareholder meetings, and any extraordinary expenses, including litigation costs in legal actions involving the Fund, or costs relating to indemnification of directors, officers and employees of the Fund.

Limitation of Liability. The Adviser will exercise its best judgment in rendering its services, except that it will not be liable for any error of judgment or mistake of law or for any loss suffered by the Funds in connection with the matterspursuant to which the New Investment Advisory and Administration Agreement relates, other than a loss resulting from willful misfeasance, bad faith or gross negligence on the part of the Adviser in the performance of its duties under the New Investment Advisory and Administration Agreement or from the Adviser’s reckless disregard of its obligations and duties under the New Investment Advisory and Administration Agreement.

Assignment. The New Investment Advisory and Administration Agreement will terminate automatically in the event of its “assignment” (as defined in the 1940 Act) by either party.

Term and Termination. The New Investment Advisory and Administration Agreement will, with respect to each Fund, continue for an initial two year term and will continue thereafter so long as the continuance is specifically approved at least annually (a) by the Board or (b) by a vote of a majority of the Fund’s outstanding voting securities, as defined in the 1940 Act, provided that in either event the continuance is also approved by a majority of the Directors who are not parties to this Agreement or “interested persons” (as defined in the 1940 Act) of any party to this Agreement, by vote cast in person at a meeting called for the purpose of voting on the approval. The New Investment Advisory and Administration Agreement is terminable without penalty, by each Fund on not more than 60 nor less than 30 days’ written notice to the Adviser, or by the Adviser on not more than 60 nor less than 30 days’ notice to the Fund.

Services to Other Clients. The New Investment Advisory and Administration Agreement provides that the Adviser may act as investment manager or adviser to various fiduciary or other managed accounts. Persons employed by the Adviser to assist in the performance of its duties under the New Investment Advisory and Administration Agreement will not devote their full time to that service and nothing contained in the New Investment Advisory and Administration Agreement will be deemed to limit or restrict the right of the Adviser or any affiliate of the Adviser to engage in and devote time and attention to other businesses or to render services of whatever kind or nature.

Differences between the Existing GEAM Agreements and the New Investment Advisory and Administration Agreement

Notwithstanding references to the New Investment Advisory and Administration Agreement as “new,” the New Investment Advisory and Administration Agreement is substantially similar to the Existing GEAM Agreements. The New Investment Advisory and Administration Agreement does not change substantially the existing terms as to: advisory services, fee rates (except for the lowered fee for the S&P 500 Index Fund from 0.35% to 0.25%), limitation of liability, term, and continuance and termination.

Below is a description of the material differences in terms between the Existing GEAM Agreements and the New Investment Advisory and Administration Agreement. The following are only summaries and are qualified in their entirety by reference to the New Investment Advisory and Administration Agreement set out inExhibit C.

Change of Adviser and Administrator.GEAM will no longer serve as investment adviser and administrator to the Funds as of the closing date of the Transaction. Instead, as of such closing date, SSGA FM will servereplaced GEAM as investment adviser and administrator to each Fund underupon consummation of the New Investment AdvisoryTransaction on July 1, 2016.

Amending the Articles of Incorporation

Because the name of the Company is set forth in the Articles of Incorporation, and Administration Agreement, if such agreementthe Articles of Incorporation do not permit a name change without shareholder approval, an amendment to the Articles of Incorporation is necessary to change the Company’s name. Currently, the FIRST Article of the Articles of Incorporation states: “The name of the corporation is GE Investments Funds, Inc. (hereinafter the ‘Corporation’).” If Proposal 1 is approved, by the Fund’s shareholders.FIRST Article of the Articles of Incorporation would be amended to read as follows: “The name of the corporation is State Street Variable Insurance Series Funds, Inc. (hereinafter the ‘Corporation’).”

Adviser’s Duties with Respect to Sub-Advised Funds.The New Investment Advisory and Administration Agreement clarifies the Adviser’s responsibility with respectA shareholder vote is being sought because an amendment to the selection and oversightArticles of sub-advisers. As is currentlyIncorporation requires shareholder approval. Thus, at a meeting held on June 9, 2016, the case for GEAM,Board approved the Adviser will be responsible for identifying and recommendingproposed amendment to the Board sub-advisersArticles of Incorporation and recommended that the amendment be submitted to manage some or allthe shareholders of the assetsFunds for their approval.

Rationale for Changing the Company’s Name

The Board believes that it is important that there be broad recognition of the Funds’ relationship with their investment adviser. In this regard, historically, and consistent with a Fund; appointmentcommon industry practice, the name of a sub-adviser is,the Company has reflected the name of course, subjectthe investment adviser to the approval of the Board and the Independent Directors. The Adviser is then responsible for overseeing generally the performance of the sub-advisers, and reporting to the Board regardingFunds. Given that performance. The New Investment Advisory and Administration Agreement makes clear the circumstances under which the Adviser will not be liable for any investment decision or any other act or omission on the part of a sub-adviser, including any failure by a sub-adviser to comply with any policies, procedures, guidelines, or objectives of a Fund.SSGA FM has replaced

147

Brokerage and Execution.The New Investment Advisory and Administration Agreement retainsGEAM as investment adviser to the approachFunds, SSGA FM determined that it would be appropriate to change the name of the Existing GEAM AgreementsCompany to brokerage and execution, requiring the Adviser to seek the best overall terms available in selecting brokers to execute transactions for the Funds. Section 28(e) under the Securities Exchange Act of 1934, as amended, provides a “safe harbor” to investment advisers who make use of soft-dollar arrangements to obtain brokerage and research services through the transactions they place for client accounts. The existing agreements appear to have been drafted to take advantage of that safe harbor. The New Investment Advisory and Administration Agreement builds on the language in the Existing GEAM Agreements, but expands such language to state expressly the standard set out in Section 28(e):

“reflect its affiliation with SSGA FM, shall not be deemedthe Funds’ new investment adviser. The proposed name change will eliminate any potential investor confusion as to have acted unlawfully or to have breached any duty created by this Agreement or otherwise solely by reason of its having caused a Fund to pay a broker or dealer that provides brokerage and research services to SSGA FM an amount of commission for effecting a portfolio investment transaction in excessthe identity of the amountinvestment adviser to the Funds and make appropriate investment option selection easier for variable contract owners.

Effect of commission that another broker or dealer wouldChanging the Company’s Name on Fund Shareholders

The name change will not have charged for effecting that transaction, if SSGA FM determines in good faith that such amount of commission was reasonable in relation toany impact on the value of the brokerage and research services provided by such broker or dealer, viewed in terms of either that particular transaction or SSGA FM’s overall responsibilities with respect to the Fund and other clients of SSGA FM as to which SSGA FM exercises investment discretion.”

This clarifying language is not intended to reflect any changeshareholders’ investments in the approach to the use of soft dollars in connection with the Funds’ brokerage transactions.

Choice of lawFunds. The investment objectives, policies, strategies and forum provisions.The New Investment Advisory and Administration Agreement contains provisions clarifying that there are no third-party beneficiaries to the Agreement in order to increase the likelihood that only the Funds and their Boards will be permitted to bring legal actions under the Agreement. The choice of law and exclusive forum provisions are intended to provide greater certainty as to the likely interpretation of the New Investment Advisory and Administration Agreement, by specifying the law that governs the Agreement and the courts that will hear any cases under the Agreement.

Matters Considered by the Board

At the Board Meeting on April 19 and 20, 2016, the Directors, including a majority of the Independent Directors, who were present at the Board Meeting considered and unanimously approved the New Investment Advisory and Administration Agreement with the Adviser on behalf of each Fund. In considering whether to approve the New Investment Advisory and Administration Agreement, the Directors considered and discussed a substantial amount of information and analysis provided, at the Board’s request, by the Adviser and GEAM.